“Money Money Money

Always funny

In a rich man’s world”

– Abba

You just got your pay check. Every time this happens, you relax. Deep down you feel that sense of financial security. You’re okay. You got money now. But before you know it… you overspend, you’re behind in bills and rent, and you’re back to square one!

This is going to be quite a long post, but I’m telling you that this will be worth it. I will have pictures below to help your understanding. I got your back!

First: grab a notebook (not a piece of paper… a notebook), pencil/pen, and a calculator.

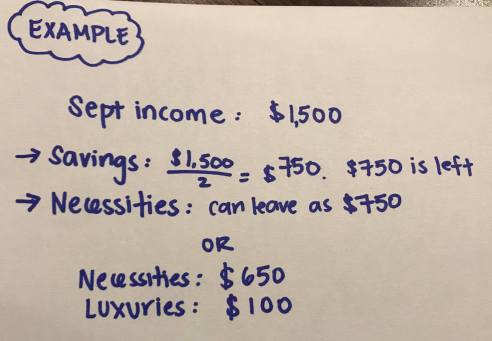

Second: the first thing you will write in your notebook is your monthly income. Don’t round it up, write the actual amount of money you received from your job. Many people round their figures but they will just be avoiding doing this process realistically (and not accurately, I might add).

Now, determine how much of your income to be put into savings. This step is very important. You need to start savings now, so try to put at least 20% into it. The point of budgeting is to save as much as you can. I personally put half to savings, or at least almost half. But it is up to you!

So you just set some money aside for savings. Now with the rest of the money, determine how much money you will leave for necessities. This includes groceries, gas, transit, and more. Things you just need to spend.

After that, set a little money aside for luxuries. You need to reward yourself sometimes and if you specifically leave money aside for this, then you won’t feel guilty about spending it! Sometimes people rather save even more money and not spend on luxuries and that is fine too.

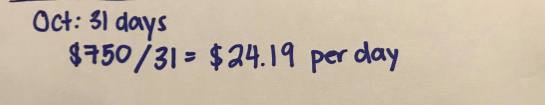

Lastly, with all of these information, calculate the amount of money you can spend per week and then per day. This will help you determine how much you need to spend and try to stick to it.

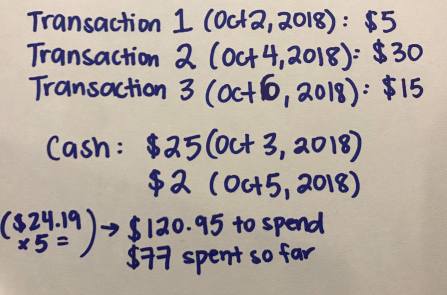

Whenever you use your credit card or debit card, get and keep copies of RECEIPTS.

I plan to make another blog post on why you need to keep receipts. But in short, it is a way to help track down how much you spend with your card.

I check my transactions every week and I would write every transaction on my notebook with dates on the side. Then I would total it up and minus with how much money you have left, and to see if I am sticking to my budget plan of the month.

Doesn’t make any sense? That’s okay. Below is an example that will help you understand what I’m talking about:

Written by Ena Que (author)

You got your September income by the end of the month. It’s $1,500. You decide to save half of it to savings, so you have $750 left for necessities or put aside $100 from it for luxuries.

Written by Ena Que (author)

Next month, October, will have 31 days. I’m going to avoid having luxuries, so I have $750 to spend for necessities. I divide $750 by 31 days, resulting $24.19 to spend per day to stay within the budget.

Written by Ena Que (author)

ANYTHING you spend in October, write down how much you have spent EVEN CASH to keep in track. Writing down is better than looking online in your online banking website because it will help you remember and organize your thoughts better. In this example, $77 was spent so far which is well under budget, which is great!

In conclusion, taking at least fifteen minutes off and writing everything down and formulating this budget plan helps. It’s worth it!

Share me your thoughts by commenting down below.

Savings are a must….financial pridence and discipline has to be enforced to follow the budget..

Beautiful article..

Agreed! I find discipline to be the hardest when it comes to budgeting.

😊😊

Very valuable post. Especially for someone like me who is rubbish at budgeting.

Aw, I hope this would help you budget a bit better. Thank you for your kind comment!

Is good to have a budget plan. With out that, people sometimes are going crazy! I know many people like that!

Same here! Planning is the best way to go 🙂

Great post. I love the idea of “paying yourself first.” I only just started saving this year. This has made me even more motivated! Thank you!

That is great to hear! I wish you the best xoxo

Very interesting post. Worth trying.

Thank you! 🙂

Planning and saving are always good backups for like , thanks for sharing

Thank you for reading!

I like the way you have laid it out. Makes sense.